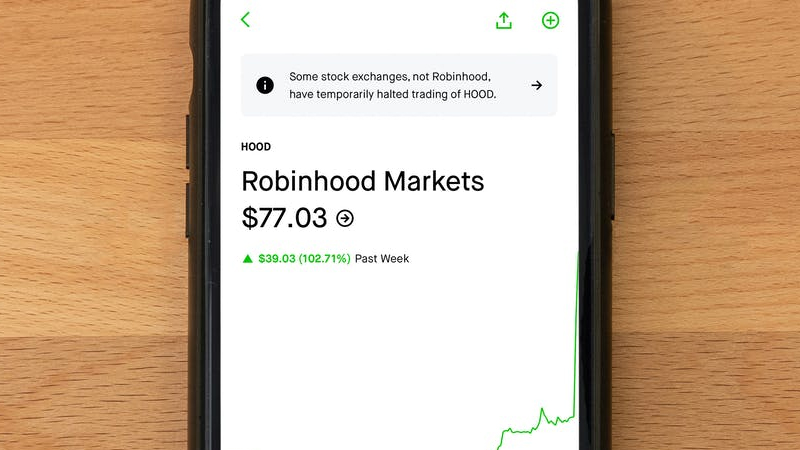

When Will Robinhood Tax Documents Be Available? (& How To Access Them)

Since Robinhood is a zero-commission brokerage firm, millions of people have opted in to trade on the platform. If you’re one of these people, there’s a requirement for you to get the 1099 tax form from Robinhood to file for your tax returns, but a lot of users on the platform do not know how to get the tax form, when the documents will be ready and how to access them majorly because they assume Robinhood hasn’t disclosed when the documents will be ready. To debunk this assumption, let’s discuss “When will Robinhood release the tax documents to its users?”

According to Robinhood, all of the tax documents will be ready and available for users by mid-February. You will be able to access the documents in your account’s statements and history once the documents are ready. If you had any reportable income or trades, you may receive more than one document.

The tax documents are used to report your income. In this piece, I’ll explain how you can access the tax documents in your Robinhood account and when the tax documents will be ready.

When Does Robinhood Release The Tax Documents?

Although Robinhood is the one to release the tax documents, the Internal Revenue Service (IRS) sets the deadline for brokers to release the tax documents to their users hence, Robinhood is acting based on the orders of the IRS.

A lot of individual brokers may have their own respective release timing, but it doesn’t extend out of the IRS’s deadline. And if any broker experiences some sort of delay in sending out the forms, the broker can request a deadline extension which may be considered by the IRS.

Robinhood reports on its website that users of the brokerage firm will have their tax documents ready by mid-February, which aligns with the deadline given by the IRS. However, in 2021, Robinhood clients experienced tax forms delays which led a lot of its users to head to social media platforms and lay complaints. The broker took full responsibility for the delay and also gave the reason which was due to special processing requirements and an issue with a vendor and as a result, the IRS granted Robinhood a 30-day extension period to get the forms sent to its users.

Even after the broker explained the delay was due to unavoidable challenges, some of Robinhood’s investors threatened to leave the broker for delaying their tax documents. For some users, it’s important they get the forms on time due to a number of reasons.

Some users may have complex issues and may miss the IRS’s return filing deadline if they don’t get the required documents from Robinhood on time, leading to them facing expensive penalties. While other people may want to complete the filing process early to be able to get their tax refunds earlier than others as many people are looking forward to the refund. Some people may have the intention of investing the money in the next exploding investment, while others might be looking forward to putting the money in a retirement savings account, or using it to pay their student loan debt.

How To Access Robinhood Tax Documents

The following are the steps to access your Robinhood tax documents on the mobile app and on the website:

On The Mobile App:

Step 1: Log In To Your Robinhood Account

To access your account options, you’ll need to be logged in to your account.

Step 2: Tap The “Account” Option

After logging in, on your home page, you’ll see the “Account” option by the bottom right corner of your screen. After clicking this you’ll be redirected to a page with options relating to your account details.

Step 3: Tap “Statements & History”

After tapping this you’ll be redirected to a page where you’ll be prompted to choose if you want to see your account statements and history, or you want to see your tax documents.

Step 4: Tap The “Tax Documents” Option.

Here, you’ll be redirected to a page where you’ll be able to access your tax documents for download.

Step 5: Tap On The Particular Tax Document.

If you’re welcomed with multiple tax documents, to access the particular tax document you want, you’ll need to tap on it and download it. Make sure the tax document is the exact one for the year you want to download and fill.

On The Website:

Step 1: Log In To Your Robinhood Account

To access your account options, you’ll need to be logged in to your account.

Step 2: Click On The “Account” Option

After logging in, on your home page, you’ll see the “Account” option at the top right corner of your screen. After clicking this you’ll see a drop-down with options about your account.

Step 3: Click On The “Settings” Option

You’ll be taken to a page where you can access all the settings required to set up your account for you.

Step 4: Click On “Documents”

At the top navigation bar, you’ll see a number of account settings options, click on documents. After clicking on documents, you’ll be taken to a page with your tax documents and your account statements summary and history.

Step 5: Click On The Tax Document

You may be welcomed with a number of tax documents so to access a particular tax document, you’ll need to click on the tax document you want to access and download it.

You can access the tax documents monthly, for your yearly taxis, and also on a basis of specific transactions. It’s also important to note that you may be welcomed with multiple tax documents if you traded both Stocks and Cryptocurrencies.

Robinhood also advises that if you’re downloading large tax documents, it’s best to download the document from its website. If you have any common tax document issues, you can visit its help center.

Why Did You Receive Multiple Tax Documents From Robinhood?

Receiving multiple tax documents is highly dependent on your account activity throughout the year. Due to this, you may receive one of the following documents or both:

- If you had a taxable event in the past year that includes interest income, miscellaneous income, dividend payments, or if you sold mutual funds/ETFs, stocks, or options, you’ll be sent a Robinhood Securities IRS Form 1099.

- If you had a taxable event in the past year that involves the sale of cryptocurrencies, or receivable of miscellaneous income, you’ll be sent a Robinhood Crypto IRS Form 1099.

If you performed both stock and crypto transactions that led to a taxable event, you’ll receive both of these forms. This is one reason you’ll receive multiple tax documents.

The other reason is if Robinhood detected that one or both of the earlier sent forms had an error and it needed to be corrected so they issued a corrected version. Usually, whenever there’s an error with a tax document, Robinhood will inform you so you can access the corrected version. You may also need to file an amended return with the IRS if there are corrections made to your already submitted tax document.

Why Didn’t You Receive A Tax Document?

There are a number of reasons you didn’t receive your 1099 tax document. The reasons are:

- You received less than $10: If you received less than $10 in dividends of interest, you will not receive any tax documents as this doesn’t serve as a taxable event that may lead to you getting a tax refund.

- Didn’t sell any stocks, or other securities: If you didn’t sell any stocks, options, or mutual funds/ETFs then you won’t receive any tax documents as not selling any security isn’t a taxable event that may lead to you receiving a tax refund.

- Didn’t sell any cryptocurrencies: If you didn’t sell any cryptocurrencies on the website, then you won’t receive a tax document as regards the sale of cryptocurrencies as no taxable event occurred. But if you sold a stock or any other security and didn’t sell cryptocurrencies, you’ll receive a Robinhood securities IRF Form 1099 without the Robinhood Crypto IRS Form 1099.

- Received less than $600 miscellaneous income: If you received less than $600 miscellaneous income within the whole year, then you won’t be sent a tax document as no taxable event occurred on your account within the past year.

How To Correct Errors In Robinhood Tax Documents

If Robinhood makes any errors in the forms sent to you, usually, it is detected at some later time and a corrected version will be issued to you for access. Usually, they inform you through an email that an error has been detected and you’ll be reissued a corrected version. This corrected version will be sent to your Robinhood account.

If you’re the one who made errors on your document and need to make any corrections, you’ll need to send a request to the support team to request for a correction. You can also visit their help center to learn more about what information is needed to make corrections on the tax document.