Nvidia Delays Blackwell Ultra Launch Until Mid-2026

Nvidia has postponed the volume production of its next-generation ‘Blackwell Ultra’ GPUs from early 2026 to the second half of the year. The delay stems from thermal and power delivery issues discovered during high-volume testing of the GB100 accelerator dies. Customers expecting first shipments in Q1 now face a six-month slip, forcing data-center operators to extend existing Hopper deployments.

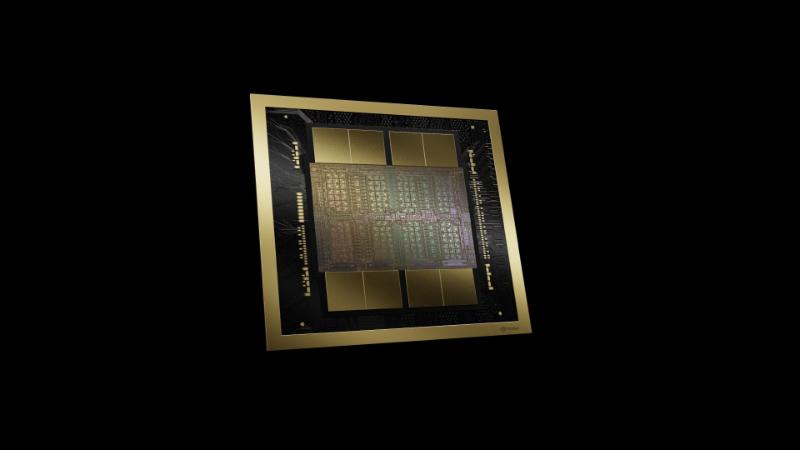

The Blackwell Ultra family targets 30 petaflops of FP4 performance per chip, a 50 percent increase over the standard B200 series introduced in March 2025. Nvidia fabs the compute dies on TSMC’s 4NP node, with CoWoS-L packaging integrating eight HBM3e stacks delivering 12 terabytes per second of memory bandwidth. Yield rates on the 800-square-millimeter interposer have stabilized at only 62 percent, well below the 85 percent required for cost-effective ramp.

Microsoft, Meta, and Google collectively booked over 1.5 million Blackwell Ultra units for 2025–2026 training clusters. The delay disrupts schedules for next-generation foundation models, with internal projections now pushing 100-trillion-parameter runs into 2027. Cloud providers have activated contingency orders for an additional 400,000 H200 Hopper GPUs to bridge the gap.

Nvidia’s supply chain partners in Taiwan report mask revisions for the power management ICs and voltage regulator modules. The GB100 die consumes up to 1,400 watts under peak load, exceeding the original 1,200-watt envelope and stressing 12-phase designs on reference boards. Liquid-cooling manifolds for the new 10-kilowatt racks also require redesign, adding three months to qualification.

Revenue impact lands between $8 billion and $12 billion for fiscal 2027, according to Barclays estimates. Nvidia’s data-center segment generated $35.6 billion in the most recent quarter, with Blackwell standard already contributing 18 percent of shipments. The company maintains a 92 percent share of accelerator revenue, but extended lead times risk inventory buildup of older generations.

Competitors gain breathing room. AMD’s MI350 series, built on TSMC 3nm, remains on track for Q2 2026 availability with comparable FP8 throughput. Intel’s Gaudi 3 refresh and multiple startups offering 800-watt chips on 5nm nodes now target the same hyperscaler sockets. Broadcom has secured an extra 150,000 CoWoS-L slots originally allocated to Nvidia for its own custom silicon.

Nvidia CEO Jensen Huang confirmed the timeline adjustment during a closed-door session at the Supercomputing 2025 conference. Engineering teams in Santa Clara and Israel added 400 validation staff to accelerate burn-in testing at 1,500-watt stress levels. The revised roadmap keeps the consumer RTX 5080 and 5090 cards on schedule for CES 2026 announcements using cut-down Blackwell dies.

Manufacturing partners expect volume shipments to begin in July 2026, with full quarterly run rate of 500,000 units achieved by October. TSMC has reserved 22 percent of its advanced packaging capacity for Nvidia through 2027 under a $28 billion framework agreement. Foxconn and Wistron have expanded server integration lines in Houston and Mexico to absorb the eventual surge.

Wall Street adjusted price targets downward by an average of 6 percent following the news. Nvidia shares trade at 38 times forward earnings, still commanding a $3.8 trillion market capitalization. The delay highlights persistent bottlenecks in advanced packaging and high-bandwidth memory supply, with Samsung and SK Hynix reporting zero excess HBM3e inventory through mid-2027.

U.S. hyperscalers now project capital expenditure of $240 billion collectively in 2026, a 12 percent sequential increase to offset the postponed efficiency gains. The setback underscores the escalating complexity of scaling beyond 1,000-watt chips while maintaining reliability margins required for 24/7 training operations.