Robinhood Account Deficit: Why It Happens & How To Avoid It

Investing in your favorite stock hasn’t been any easier without Robinhood as the platform provides the most user-friendly investment platform for amateur traders who are looking to invest long-term in stocks, options, EFTs, and even cryptocurrencies. Robinhood has seen an influx of users looking to invest their money on assets available on the platform, making it one of the best brokerage firms out there. To be able to understand the rules that govern the platform, it’s important to know if users of the platform can experience an account deficit fee.

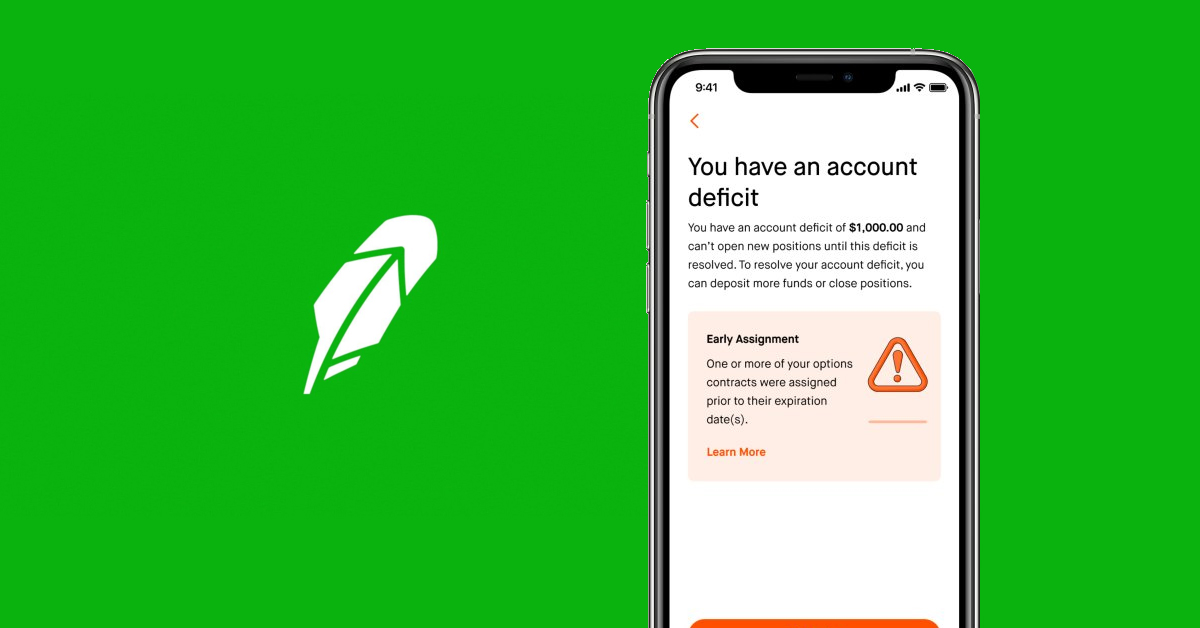

Yes, you can experience a Robinhood Account deficit if you’re being charged a fee and you do not have enough funds in your Robinhood account. This fee is usually triggered due to you being charged with the Robinhood gold fees and you do not have enough funds in your account to cover the fee.

In this piece, I’ll share with you the reasons why Robinhood Account Deficit happens and how you can avoid it. I’ll share with you in detail why the account deficit happens, its meaning, and how you can indulge the best practices to not experience the deficit.

Can You Experience Robinhood Account Deficit?

Yes, you can experience a Robinhood account deficit if you’re being charged a fee and you do not have enough funds in your account to pay the fee back. This is why your account balance shows a negative balance and prompts you to make a deposit to clear the deficit. The account deficit message is often triggered due to the brokerage firm charging you the Robinhood gold fees and is associated with American depository receipts.

If your Robinhood account doesn’t have enough brokerage cash and the platform charges you a fee that you cannot cover due to an insufficient balance in your account, the fee will be deducted from your balance and your brokerage cash will now show a negative balance.

This deduction is called the Robinhood account deficit and you’re required to pay the money back to get your balance back to 0 if you want to continue trading and investing with the brokerage firm. The most popular fee that triggers the account deficit are Robinhood Gold fees and American Depository Receipts (ADRs)

If you do not pay the Robinhood Account deficit, there are tendencies that your Robinhood account may be locked or Robinhood may be forced to sell your securities or stocks with or without your prior approval.

If you suffer an account deficit and you do not have securities or stocks that Robinhood can sell to cover your deficit, the platform may be forced to block your trading account and maybe remove your account from its database. Hence, to avoid this, you need to pay back your deficit by making a deposit into your account so the deficit will automatically be deducted from your account.

Why Does Robinhood Account Deficit Happen?

There are a lot of reasons why your Robinhood account may suffer a deficit but the basis is clear— you owe Robinhood some money, hence why you were hit with an account deficit.

Now this deficit may be due to a fee sent to your account when you had $0 in your brokerage cash, or you were charged a fee from your account and the amount in your brokerage cash wasn’t enough to cover the fee, thereby leaving some fee back in your account which is then turned to an account deficit.

For instance, the most popular cause of Robinhood account deficit is when users are charged the gold account fee and they have $0 or insufficient funds in their brokerage cash balance, leading to Robinhood deducting the fee from the brokerage cash balance, leaving the account balance negative.

Once your account shows negative, this means you have been hit with an account deficit and will need to make a deposit to clear the deficit from your account. You will not be able to perform any transaction on your account until you’ve cleared this deficit by making a deposit into your account and clearing the negative brokerage cash balance.

You may also suffer a deficit due to the American depositary receipt fees being deducted from your brokerage cash balance if your cash balance is $0 or below the charged fee. The fee will be deducted from your account irrespective of your brokerage cash balance which leaves your balance negative, therefore leading to a deficit.

Just like the gold fees, you’ll need to make a deposit into your brokerage cash balance to clear the deficit and remove the negative from your cash balance so you can prevent your securities or stocks from being sold and resume investing in stocks, options, and cryptocurrencies.

How To Avoid Robinhood Account Deficit

A Robinhood account deficit can potentially lead to Robinhood taking over your assets and selling your stocks or securities to cover your deficit. This is quite bad if you end up losing your investments to the account deficit hence, it’s important to take precautionary steps to help you avoid being hit by an account deficit and your stocks and assets being sold to cover the deficit.

The very first practice to avoid an account deficit is to make sure that you are aware of the upcoming bills that may be charged by Robinhood and can plan towards it so you won’t have to experience an account deficit. Being aware of this will help you plan toward the date at which the bill will be charged so you can either have some money left in your brokerage cash balance to cover the fee, or make a deposit when your account is charged.

Abiding by the former is the best solution to make sure you don’t get hit with a deficit if you are unable to make a deposit into your account due to network issues or some other reasons that may arise when trying to make the deposit.

You can also make sure that you always have funds in your brokerage cash balance so whenever a fee is going to be charged from your account, it will be easily charged from the funds you have in your brokerage cash balance.

For instance, if you’re supposed to pay a $50 bill for your Robinhood gold account at the end of the month, make sure that you have at least $50 in your brokerage cash balance so whenever the bill is sent, it is easily deducted from your balance and you won’t need to be hit with a deficit. If you have a lower balance in your account, the balance will be deducted and your cash balance will show a negative of the remaining money you’ll need to pay to complete the bill.

How To Solve Robinhood Account Deficit

To reverse an account deficit, you need to make an instant deposit into the account. You can use Robinhood’s instant deposit feature to deposit up to $1000 into your Robinhood account to reverse the account deficit. When you perform an instant deposit, you will need to wait for a settlement period for your deposit to be fully processed by Robinhood which may take up to 5 business days.

After the instant deposit has been confirmed and your funds have been settled, it’ll take up to 2 business days for the account deficit to be deducted from the deposit made. Once the deduction has happened, your account will return back to normal and the deficit will be reversed or removed.