Nvidia Evaluates Expanding H200 AI Chip Production for Chinese Market

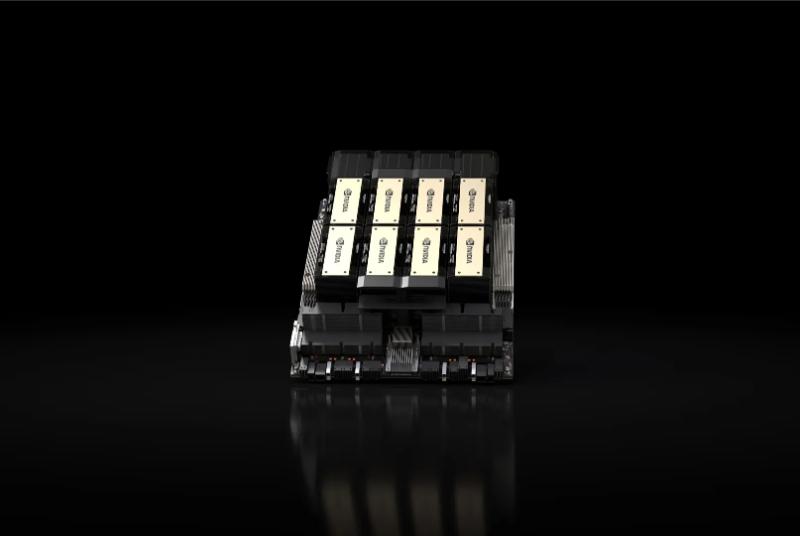

Nvidia has informed Chinese customers that it is assessing additional manufacturing capacity for its H200 artificial intelligence processors. Demand from China has surpassed the company’s existing output levels for this model. The H200 delivers enhanced performance compared to prior generations, supporting larger-scale AI training and inference tasks.

Chinese clients continue to seek access to Nvidia’s advanced chips despite ongoing U.S. export restrictions on certain high-end models. The evaluation focuses on increasing supply of the H200, which remains eligible for export under current regulations. Two sources familiar with the discussions confirmed Nvidia’s communications to customers.

This development highlights persistent strong demand for Nvidia’s AI hardware in China, the world’s second-largest economy. Chinese firms rely on such chips for developing domestic AI capabilities amid geopolitical tensions over technology access. Nvidia holds a dominant position in the global market for graphics processing units optimized for AI workloads.

The potential capacity expansion would involve coordinating with manufacturing partners, primarily Taiwan Semiconductor Manufacturing Company. Any increase aims to address order backlogs without violating U.S. controls that limit exports of Nvidia’s most powerful chips, such as the H100 and Blackwell series.

Nvidia’s revenue from China represented a significant portion prior to tightened restrictions. The company has adapted by offering compliant variants tailored for the market. Analysts note that sustained demand underscores China’s push to build independent AI infrastructure.

U.S. policymakers continue monitoring exports to prevent advanced computing resources from supporting military applications. Nvidia maintains compliance with all applicable laws while serving global customers. The H200 features higher memory bandwidth and efficiency gains suited for large language model operations.

Industry observers anticipate that added production could help stabilize supply chains for Chinese data centers and research institutions. Competitors like Huawei develop alternative chips, but Nvidia’s ecosystem remains preferred for many developers. This situation reflects broader competition in AI hardware between U.S. and Chinese entities.

The assessment process involves internal reviews of fabrication availability and demand forecasts. No final decision on expansion has been announced publicly. Nvidia shares have benefited from overall AI boom, though regional sales fluctuations impact quarterly results.

Chinese regulators encourage local procurement, yet imported compliant hardware fills gaps in cutting-edge performance. The H200 supports up to 141 gigabytes of HBM3 memory, enabling faster processing of complex AI tasks. Market dynamics continue evolving as both nations invest heavily in semiconductor self-sufficiency.