Jellifin vs Robinhood Which One is Better in

Jellifin vs Robinhood: Which One is Better in 2021

Online investing has rapidly grown these past few years. Brokerage platforms have become available for investors right, left, and center. Most of these platforms are customized to meet your needs as an investor. Whether you are a new or a sophisticated trader, accessing these markets have become easy and inexpensive. Robinhood and Jellifin are two trading platforms you will or have come across in these financial markets. So, which one is better in 2021?

Compared to Jellifin, Robinhood is the better trading platform in 2021 because of its newly introduced features, cryptocurrency trading, and affordable fees.

Both of these platforms have much to offer. In this article, you will learn more about Jellifin and Robinhood. Let’s get started!

Overview of Jellifin

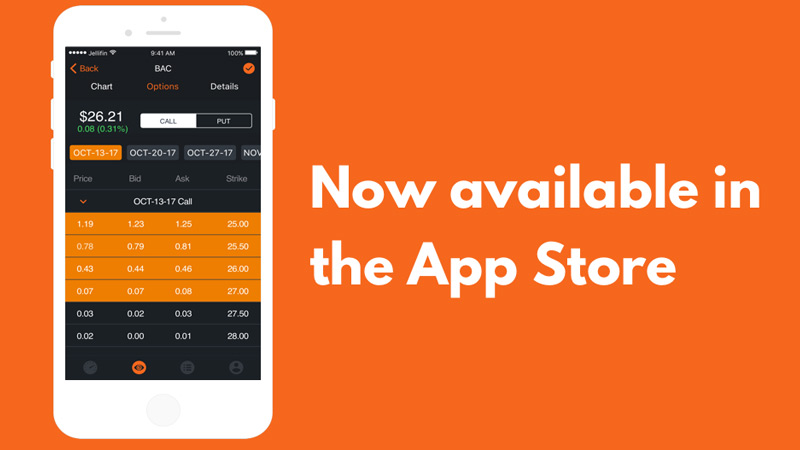

Currently rebranded as Rho, Jellifin is a commission-free investing platform available on the web and as an application. On Jellifin, you can trade commission-free stocks, ETFs, and options. You can also access unlimited daily cash accounts, data in real-time, and premium level options trading.

There is no monthly subscription required to trade unlimited ETFs and stocks. However, there is a premium subscription for options trading and market data streaming.

On this app, you can open multiple accounts and access them at the same place. This platform is also capable of handling advanced strategies such as OCO with ease.

Overview of Robinhood

Founded in 2013, Robinhood is a no commission investing app and web platform. Here, you can trade stocks, options, ETFs, and cryptocurrencies at zero commission. New features have been introduced (in 2021), recurring investments, and DRIP to increase user’s benefits.

No account balance or fee is required to open an Account with Robinhood. For more than $1000 worth of share, you can invest as little as $1 for a fraction of the share. There is also a premium account (gold) where you will have access to research and in-depth market data at a monthly fee of $ 5

Robinhood is a great platform for beginner investors and mobile phone users. The mobile app is more in-depth than the simple basic web platform. You can only open a taxable investment account because bonds and mutual funds are not available.

Trading Fees on Jellifin

Similar to most platforms, Jellifin offers you zero commissions on stocks and ETFs. You will, however, pay an additional monthly fee of $40 if you want to include options trade. Jellifin app gives access to “tick-by-tick” data that you can stream and research. This too requires an additional $19.94. For transfer of accounts, $75 will be charged.

The table below illustrates Jellifin’s trading fees.

| Fees | Amount |

|---|---|

| Stock and ETFs | $0 |

| Stocks, ETFs, + Options | $40 |

| Data Streaming | $19.99 |

| Outgoing Account transfer | $75 |

Trading Fees on Robinhood

Robinhood trading fees are relatively cheap. Regardless of most investors declaring zero commission fees, they have tried to stay true to their initial agenda. To help investors trade at least possible fees as shown below.

| Fees | Amount |

|---|---|

| Stocks and ETFs | $0 |

| Stocks, ETFs, + Options | $0 |

| Data streaming | $5 |

| Outgoing Account Transfer | $75 |

Fees Compared

There is no platform between these two that is completely free as you have seen above. Both of these platforms are beginner-friendly. It is always crucial for an investor to go for a platform that suits their needs fully.

To help you understand which platform to pick, why not do a trading fees comparison? For the comparison, you need to list down various fees incurred on various platforms. Compare them against each other as shown below.

AMOUNT

| FEES | JELLIFIN | ROBINHOOD |

|---|---|---|

| Stocks and ETFs | $0 | $0 |

| Stock, ETFs, + Options | $40 | $0 |

| Data Streaming | $19.99 | $5 |

| Outgoing Account Transfer | $75 | $75 |

Which one is better Jellifin or Robinhood

This might be a tougher decision to make than it seems. This is so because you have to pick one regardless of these apps having great service provision. You will need to dig deeper into what makes one better than the other.

You can do this by comparing both advantages and disadvantages of your prospective platforms. In this case, our platforms are Robinhood and Jellifin.

Without further ado, let’s dive right into it!

1. Cryptocurrency

Cryptocurrency is rapidly dominating these trading markets. Most investors are looking for platforms that offer cryptocurrency trading. Are you a cryptocurrency investor? Then Robinhood is for you.

Robinhood has a section in the platform called Robinhood crypto where Bitcoin, Dogecoin, Ethereum, and more cryptocurrencies are traded. Jellifin on the other hand only offers a trade for stocks, options, and ETFs.

2. Accounts

The number of accounts you are willing and able to open on a platform should you drive your decision. How many accounts can you open on either of these platforms?

Jellin shines in this sector because you can open multiple accounts with them. These accounts include Roth IRA, joint, and traditional IRA. What is even better is that all these accounts can be accessed from the same app. The number of accounts on Robinhood is limited to only one taxable investment account.

Jellifin again takes all the glory because of its cash account option. This is something that’s in constant demand by novice and small investors. Robinhood does not offer this account.

3. Usability

Despite these platforms being user friendly, it depends on what suits you. Robinhood usability is simple and streamlined. This means that it meets only basic investors’ needs suitable for novice investors. This is both a positive and a negative for Robinhood because this can be outgrown by advancing traders.

Jellifin is on the other hand suited for both beginners and advanced investors who are phone lovers. With the phone on your hand, you can do extensive research, access data in real-time, and manage your various accounts, etc. What’s more interesting is that this app can be customized.

4. Information and customer service

It is hard to compare Robinhood to other platforms because they don’t publish their trading statistics. Robinhood gold customers have access to limited research for $5 a month. Jellifin however offers extensive research and clear company’s earnings, financial ownership, and more.

Customer service is one of the most crucial parts of marketing. Because of poor customer support, Robinhood is losing customers and being downrated. They provide support tickets or email support which do little to help the users instead of helpline call support. Jellifin’s users pride themselves for the quick and useful customer support they are offered.

5. Fees

As shown earlier in the article, it is evident that although both platforms advertise commission-free trading, Robinhood aces in this sector. It stays in line with its mission of “democratization”. Jellifin is not so bad either if the other fees incurred are worth what you are looking for.

6. New features 2021

Other than Jellifin partnering with traders in 2021, there are no new features introduced to the platform. Robinhood on the other hand has been busy trying to retain and attract more customers.

Early this year, they introduced DRIP (dividend investment program) and recurring investments. This is looking good for beginner investors. For example with recurring investments, all you need is a schedule and any amount. With this set, the platform can invest for you when you want anytime.

From the above analysis, it is now easier to decide which is better between Jellifin and Robinhood. It is clear that both of these platforms are good but Robinhood is better. The new features introduced by Robinhood raises the bar for Jellifin. More of this, it offers cryptocurrencies trade and remains the most affordable platform to start if you’re a beginner in 2021.