How To Withdraw Money From Varo Without A Card

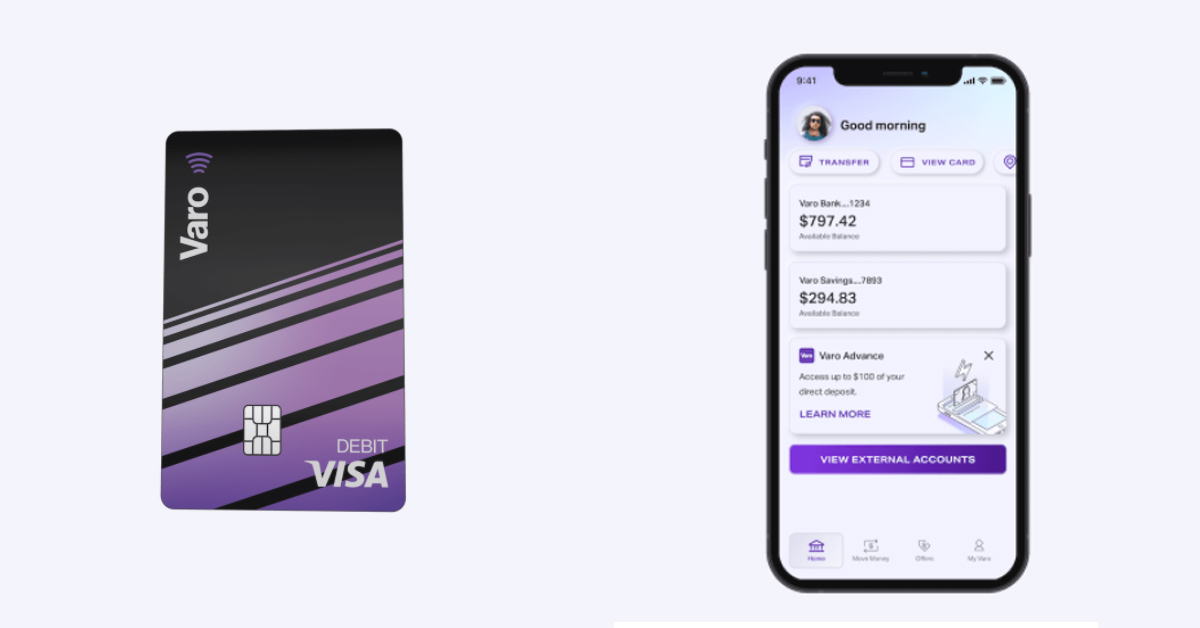

Varo is renowned for its secure online banking system that offers a hassle-free banking experience for those who prefer to manage all their finances online. Knowing how to withdraw money from Varo without a card can enhance your banking experience, but what if you need cash from an ATM and don’t have your debit card?

With the latest cardless ATM technology, cash withdrawal is made easy. No more need for an ATM card, just use your bank’s app on your smartphone and have a bank account with that bank for smooth, cardless transactions.

While cardless ATMs may not be widely available yet as they’re a new concept, we’ll explore other options in this article. So, if you’ve lost your debit card or left it at home, I’ll show you how to get cash without one.

What Is The Best Way To Withdraw Money From Varo Without A Card?

To minimize the risk of carrying your debit card or in case you’ve lost it, there are several options for withdrawing money from Varo without a card. The safest way is to use a digital bank cardless ATM. However, prior to the introduction of cardless ATMs, here were some alternatives:

Using apps such as Google Pay, Apple Pay, or PayPal:

Your Varo debit card information is stored in your bank app, so you can simply open one of the above-mentioned apps and add the card details. After adding the details, a verification process will take place, which includes receiving an OTP (One-Time Password) to your registered number. Once you enter the password, your verification will be completed and you can use your Varo card through these apps.

Transferring funds to another bank account:

This works if you have another bank account linked to your Varo account and you have that account’s debit card with you. Although this process takes time as transfers can take up to two days to finalize, you can transfer money from your Varo account to another bank by following these steps.

To transfer money from your Varo bank account:

- Open the Varo bank app and select “MOVE MONEY” > “TRANSFER MONEY”.

- Choose “From: Varo Bank Account” and “To: the account you want to receive the money”.

- Check the transfer limit under the transfer amount.

If a friend needs money and has their debit card with them, you can transfer funds to their account for them to withdraw cash. Transfers between Varo accounts are free and instant. Here’s how:

- Log in to your Varo app and select “MOVE MONEY” from the bottom of the screen.

- Choose “Varo to Varo transfer”.

- Enter your friend’s email address.

- Enter the amount you want to send.

- Review the transfer details and select “SEND MONEY”.

With the introduction of cardless ATMs, these processes are no longer necessary unless a cardless ATM is not accessible.

What Are Cardless ATMs?

With cardless ATMs, you can perform bank transactions without using a debit card. Instead, they use smartphone verification through an SMS message or bank app. These ATMs link your smartphone app to the machine via technologies like app generated codes or Near-field communication (NFC).

The first cardless ATM was introduced by Bank of America in 2016 and since then, many other banks like Chase, BMO Harris, and Wells Fargo have followed suit, including Varo. The ATM experience is similar to using a physical debit card.

Near-Field Communication (NFC)

Cardless ATMs use near-field communication (NFC) to connect your digital debit card information to the ATM. NFC is a short-range technology that allows you to simply hold your smartphone near the ATM’s receiver to transmit data via radiofrequency. Many people who use Apple Pay, Google Pay, Samsung Pay, or credit cards with an NFC chip are already familiar with this technology.

To use an NFC-enabled cardless ATM, simply open your mobile wallet or banking app on your smartphone and hold it near the ATM’s NFC receiver. After the ATM completes the verification process and confirms receipt of your information, you can perform your banking transactions just as you would if you inserted a debit card.

App-Generated Codes

For app-generated codes, there are several methods to generate codes for verification, including QR codes, mobile app verification codes, and biometric verification.

QR Codes

QR codes, similar to barcodes, can be scanned using a smartphone camera. They can communicate more information than a traditional barcode.

At ATMs with QR technology, a QR code will be displayed on the screen for you to scan with your mobile banking app. Once your identity is verified through the app, you can complete your transaction at the ATM.

Mobile App Verification Codes

Mobile App Verification codes offer extra security for your transactions by acting as a 2FA. When using cardless ATMs, you can complete most transactions through your Mobile App. Simply log in, choose your transaction, and the app will generate a one-time code to enter into the ATM along with your PIN.

Biometric Verification:

This feature requires a device equipped with biometric data such as a fingerprint or facial recognition for identity verification. Your bank must have your biometric details on file. At a cardless ATM, the machine scans your biometric data, such as a fingerprint or iris, and compares it to your bank’s records. Upon confirmation, it grants access for you to complete your transactions.

Do Cardless ATMs Work With Varo?

Varo now enables cardless transactions on ATMs via their mobile banking app, dispelling the misconception that cardless ATMs don’t work with Varo.

By integrating this feature, Varo continues to fulfill its mission of making online banking more convenient for users in the digital age. Linking your Varo Visa debit card to your smartphone for cardless transactions is simple and secure.

Additionally, Varo’s mobile app includes an ATM locator to help you find the nearest Allpoint cardless ATM.

How To Withdraw Money From Varo Without A Card

Withdraw cash from Varo without a debit card:

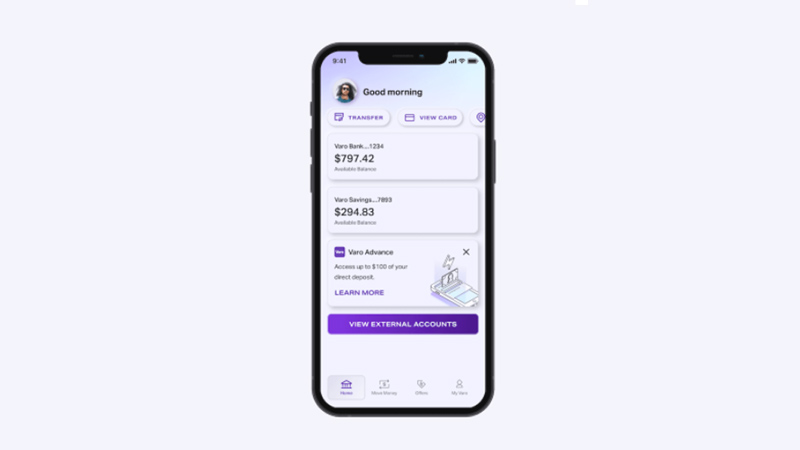

- Open Varo Mobile App

- Go to “MOVE MONEY”

- Click “FIND ATM”

- Locate nearest cardless ATM

- Visit cardless ATM with smartphone

- Check for mobile cash access support

- Open Varo app, select cardless withdrawal option

- Enter withdrawal amount

- Scan QR code or enter verification code

- Enter code at ATM

- Wait for cash release

- Complete transaction.

Do Cardless ATMs Take Provision?

Cardless ATMs may ask for details like pins and codes based on the verification method selected. With NFC, entering a pin may be required after connecting to the ATM. For App-generated codes, transactions are done on the phone, and cash is dispensed once the QR code is scanned.