Robinhood Vs Ustocktrade: Which Is Better?

Robinhood and Ustocktrade are both similar platforms in the sense that they’re about brokerage firms that allow traders and investors to trade stocks. Both platforms have a lot in common but also have a lot of differences, but as a trader who has trading ambitions and is looking to choose the best trading platform for yourself, it’s important to understand which platform is better for you in terms of the features you’re looking for in a trading platform that terms it the perfect trading platform for you. With that being said, let’s look at the features of these two trading platforms to help you choose the best out of them.

If you’re one of those who’d rather trade your funds and stock with a broker that offers commission-free trades, then Robinhood is your best bet. But if you’re looking for a peer-to-peer stock trading system that eliminates the use of brokers, then you can opt-in for Ustocktrade.

Although Ustocktrade isn’t free as it attracts a commission of $1monthly, Robinhood is a completely free broker for starters and investors. In this article, I’ll help you make the best decision on which stock trading platform to choose by sharing the features of both platforms and their pros and cons.

Robinhood Vs Ustocktrade Differences

Broker Vs ATS

Robinhood is one of the most prominent brokerage firms that allows investors to trade all kinds of stocks, including ETFs, ETNs, US company-listed stocks, and cryptocurrencies while Ustocktrade was created as an ambitious stock trading system (ATS) offering limited stocks to trade (like ETFs, ETNs, and US company-limited stocks) but allows unlimited day trades.

As a broker, Robinhood trades its investments with traders and investors, allowing them access to different kinds of stocks, options, and cryptocurrencies. But as an ATS, Ustocktrade pairs its busters and sellers for counterpart transactions in very limited securities.

Commission

Robinhood is commission-free while Ustocktrade has a $1 commission. Robinhood is popularly known for pioneering the commission-free trade movement and continues to top the list as one of the best-priced trading applications on the market. Ustocktrade on the other hand is not commission-free but offers unlimited day trades and zero minimum account size with free one-day transfers.

Investments

Robinhood provides its traders and investors with unlimited, commission-free trades across the following investment products:

- Stocks and funds: Robinhood allows you to browse over 5,000 available stocks and ETFs, including fractional shares for as little as $1.

- Options: You can also explore options trading with zero per-contract fees.

- Cryptocurrency: You can buy and sell 17 different cryptocurrencies any time you choose. These cryptocurrencies include Bitcoin, Litecoin, Ethereum, etc.

- IPOs: Robinhood recently added a feature that allows its users to make offers for shares of selected initial public offerings (IPOs) at IPO before the shares are launched for trading.

Ustocktrade connects its buyers and sellers for alternate transactions in the following securities with a $1 commission:

- Stocks: Ustocktrade provides the majority of the stocks listed on US stock exchanges to its buyers and sellers for trading.

- ETFs: Ustocktrade allows its traders access to Exchange-traded funds (ETFs). This lets you buy and sell bundles of securities.

- ETNs: You can also invest in exchange-traded notes (ETNs). ETNs are debt securities linked to a market index or benchmark.

Fees And Costs

Robinhood’s trades have been commission-free since its inception in 2015. During this time, brokerage firms with zero commission fees were a pretty big deal. This gave Robinhood an economic edge over its competitors, but today, a lot of other trading platforms have reduced their commission fees, making it tough for Robinhood to market itself as a commission-free broker.

On this note, here are the details of Robinhood’s fees and costs.

| S/N | Detail | Fee |

| 1. | Minimum Deposit | $0 |

| 2. | Annual Fee | $0 |

| 3. | Stock Trade Fee | $0 |

| 4. | Option Trade Fee | $0 |

| 5. | Inactivity Fee | $0 |

| 6. | Robinhood Gold | $5 per Month |

On the other hand, Ustocktrade also provides no account minimums but has very low commissions. This may appeal to many day traders, but the list of available instruments to trade is limited compared to Robinhood. There’s also a trading limit of $10,000 per trade that discourages active traders. Here is more information on account details, prices, and fees on Ustocktrade:

| S/N | Details | Fees |

| 1. | Intro or bonus offer | None |

| 2. | Minimum Investment | $0 |

| 3. | Stock trade fee | $1 |

| 4. | Monthly membership fee | $1 |

| 5. | Account transfer fee | $0 |

| 6. | Annual fee | $12 |

Research Tools

Robinhood provides rudimentary research tools. Robinhood’s free account provides some basic research tools to help you understand the market and stay on top, but professional investors and day traders may need more than the rudimentary tools.

With the account, you’ll get a feed of news articles about the market and specific stocks and companies from websites like MarketWatch, Financial Post, Reuters, and the New York Times, along with prompt daily information on the best stocks and which stocks are moving well.

But if you opt-in for Robinhood Gold for an additional $5 per month, you can sign up to receive morning star and Nasdaq level 2 Market DataStock research reports.

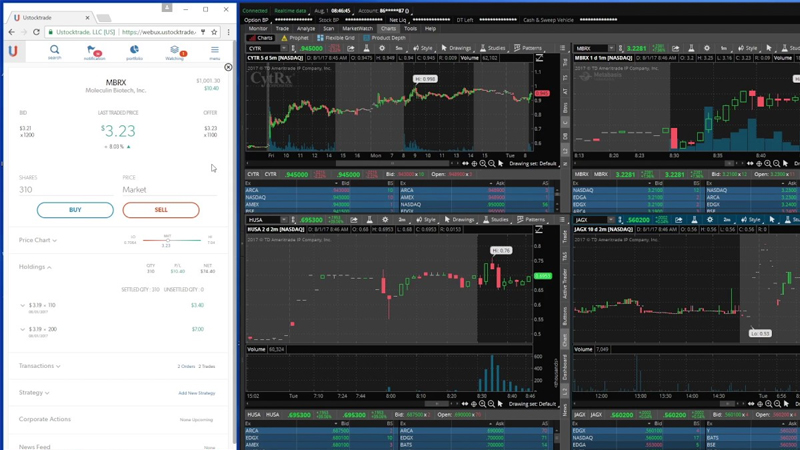

In Ustocktrade’s case, they do not provide as many research tools as Robinhood because their research sources are very limited but if you prefer to spend your time on the charts to do technical analysis, then they have enough tools in this aspect. You’ll get candlestick charts for better analysis, reports about realized and unrealized trading profits in taxable portfolios, etc. Ustocktrade’s interface helps you calculate the estimated dividends that you’ll receive in real-time, as well as access to other third-party news sources.

Ustocktrade’s user-friendly interface also gives its traders and investors research, management, and trading privileges on a single screen. This means you can research, manage, and place trades on a single screen. The downside of Ustocktrade is that it doesn’t offer the full array of research available but for new traders, the trading platform offers Ustocktrain- a free training simulator that gives users virtual cash to simulate trading using provided real-time data.

Robinhood Vs Ustocktrade: Which Platform Wins?

In terms of purpose, Robinhood wins because it’s a brokerage firm and not an ambitious stock trading system that rather pairs buyers to sellers. Most traders and investors would rather trade with a certified and well-known broker than an ATS.

If you’re considering the commission fees, Robinhood also wins as it provides commission-free trading. Although Ustocktrade’s commissions are also very low, if you subscribe to Robinhood Gold’s account you get more features and trading tools than Ustocktrade provides. Robinhood’s commission-free feature has put the trading platform above all other platforms because traders will rather trade with a commission-free platform than a paid one.

In addition, Ustocktrade has a $10,000 limit per trade while Robinhood doesn’t have a limit to the amount that can be invested by a trader per trade. This makes Robinhood more preferable over Ustocktrade if you’re looking to perform a higher amount per trade.

Robinhood also provides more instruments to be traded than Ustocktrade hence, making it more preferable for trades than Ustocktrade. This is because it provides a wide variety of trading options across stocks, options, cryptocurrencies, and even IPOs.

Overall, with all the listed differences, Robinhood is preferable for traders compared to Ustocktrade hence Robinhood wins.