Nvidia Invests $2 Billion in Synopsys to Accelerate AI Chip Design Tools

Nvidia bolsters its AI ecosystem through a $2 billion equity stake in chip design software provider Synopsys. The investment funds a multi-year collaboration to create accelerated simulation tools for complex product designs. This partnership targets inefficiencies in virtual prototyping, where traditional processes span weeks but could compress to hours using Nvidia’s graphics processing units.

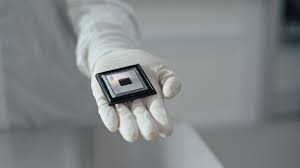

The transaction involves Nvidia acquiring Synopsys common stock at $414.79 per share, a 0.8% discount to the prior close. Synopsys, valued at $75 billion prior to the announcement, uses the capital to enhance its electronic design automation suite. The companies, mutual customers, integrate Nvidia’s CUDA parallel computing platform with Synopsys’s TestMAX and Verdi verification environments. This enables real-time analysis of semiconductor layouts exceeding 100 billion transistors.

Synopsys reported $6.1 billion in fiscal 2025 revenue, with 45% from North American clients including Qualcomm and Broadcom. The deal expands access to Nvidia’s H100 and upcoming Blackwell GPUs for design optimization in automotive and aerospace sectors. Engineers gain 10x faster cycle-accurate simulations, reducing iterations from 50 to five per project phase.

Nvidia’s CEO Jensen Huang described the speedup as unlocking unprecedented opportunities in high-tech manufacturing. Synopsys CEO Sassine Ghazi emphasized the non-exclusive nature, stating openness to similar integrations with AMD or Intel. The collaboration aligns with U.S. export controls on advanced chips, prioritizing domestic innovation amid $52 billion in CHIPS Act funding.

Post-announcement, Synopsys shares rose 4.9% to $418.22, while Nvidia climbed 1.4% to $142.50 in after-hours trading. The investment follows Nvidia’s $5 billion stake in Intel’s foundry unit and $1.5 billion in CoreWeave’s cloud infrastructure. Analysts at Piper Sandler project the electronic design automation market reaching $18 billion by 2028, with AI-driven tools capturing 30% growth.

For U.S. startups in Silicon Valley, this accelerates access to subsidized GPU clusters via Synopsys’s cloud portal. The tools support federated learning for privacy-preserving design sharing across teams. Cadence Design Systems, Synopsys’s rival, reported a 12% quarterly uptick in AI module sales, signaling sector-wide momentum.

The partnership addresses power constraints in data centers, where GPU clusters consume up to 700 watts per chip. Synopsys incorporates Nvidia’s NVLink interconnects for multi-node simulations handling 1 petabyte datasets. This reduces carbon emissions by 40% through fewer physical prototypes, per internal benchmarks.

Regulators under the Federal Trade Commission monitor such consolidations for antitrust risks, given Nvidia’s 88% share in AI accelerators. The deal complies with Hart-Scott-Rodino thresholds, avoiding immediate scrutiny. Boeing and General Electric, early adopters, deploy the tools for turbine blade modeling, cutting development timelines by 25%.

This infusion positions Synopsys to repatriate 20% more R&D from Asia, creating 500 engineering jobs in Austin and Santa Clara. Nvidia’s broader spree, totaling $10 billion in 2025 deals, fortifies supply chains against geopolitical disruptions. As U.S. firms like Tesla integrate these workflows, the collaboration drives a projected $500 billion in AI hardware demand by 2030.