How to See How Much Money you Have Invested in Robinhood

For any newcomer to the platform, you will have many questions of which you want information rapidly. One of the first questions you might have is: how to see how much money you have invested in Robinhood.

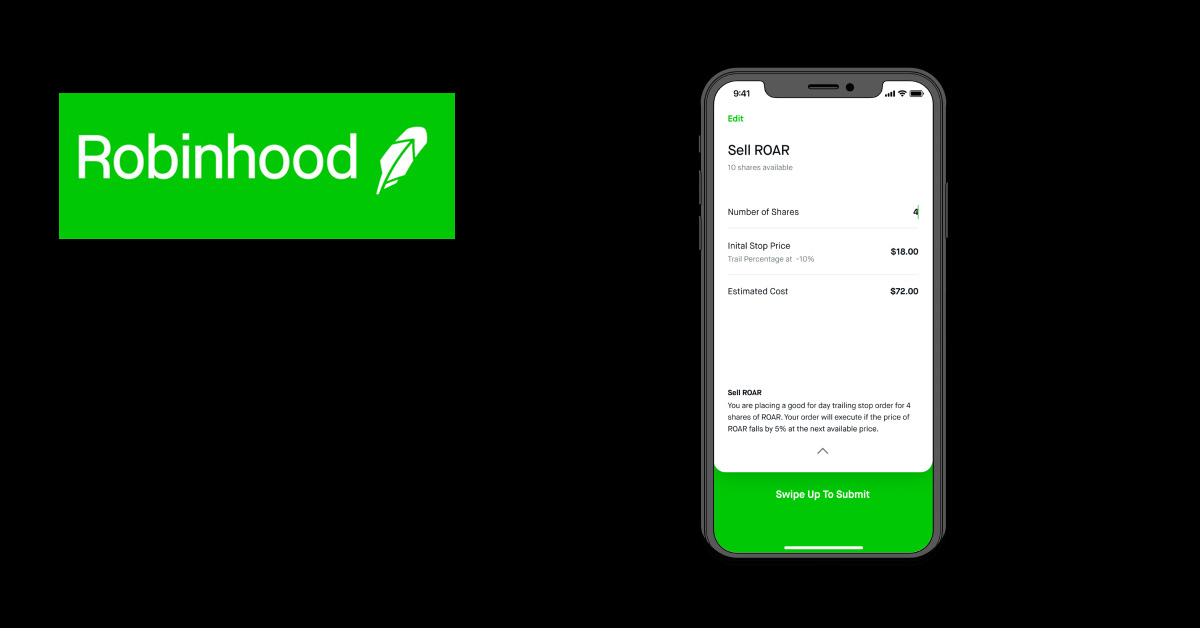

You can see how much money you have invested in Robinhood by clicking on Account at the web page or by clicking on Portfolio at the mobile app, which also lets you customize notifications and control the flow of information.

The following three sections will be dedicated to answering your most pressing questions.

How Much Does the Average Person Have Invested in Stocks?

According to a recent article published by pewresearch.org, more than half of American households have invested in the stock market. There is no denying that the worldwide Coronavirus pandemic has had dire consequences for the stock market in general by spreading a significant amount of uncertainty amongst investors.

In 2020 the S&P 500 exchange dropped from 3386 on the 19th of February, and a few short weeks later, on the 20th of March, it fell to a further 2305. This means that a loss of 32% was experienced in this time alone.

Compared to the infancy phases of the Great Recession some year ago, the current rate of decline is much sharper. For the Great Recession, it took 12 months to reach the same low point.

The latest data released in 2016 gives valuable insight into the stock market investment of the average American. Apparently, only 14% of families in the USA have invested directly in individual stock options, while 52% have a small investment in the market. Most of these figures are made up of retirement accounts.

The various demographic groups play an intricate role in stock market participation. Families with a joint annual income lower than $35 000 have a ⅕ stock commodities in the market. As the annual income increases, so do the stocks (indirectly or directly).

Of annual household incomes worth more than $100 000, 88% of those families own stock. For families with income lower than $35 000, the median amount is $10 000 or less than that. For higher-income earners, the median amount is more than $130 000.

Families consisting of white adults as the main income generators are reportedly more likely to trade on the market in comparison to Hispanic or black male adults. When looking at the figures, we found that 61% of white families that are non-Hispanic and 28% of Hispanic families have invested in some form of stocks, shares, and other commodities.

Naturally, the information will present itself differently according to age-related statistics as well. Out of the individuals under the age of 35, 41% have invested in shares, either indirectly or directly.

This is relative to the families that are headed by individuals between the ages of 35 and 64 and those older than 65. The commodities that have been gained will also be different between the age brackets.

It is reported that the median amount that the younger families have invested is quite small and is said to be in the range of $7 700 on average. For families that are run by 35 to 44-year-old individuals, the median amount is approximately $51 000. For the age bracket of 45 to 54, the median amount is $80 000.

In general, stocks, in particular, will represent a more significant market share of the commodities’ total value in some groups. Households with an income of more than $100 000, their shares made up a quarter of their total commodities and shares. For households with an income lower than $53 000, their shares made up approximately 10% of their entire portfolio.

Unfortunately, we can’t predict the direction of stock market prices. The Great Recession caused the S&P 500 exchange to lose almost 53% of its total value between October 2007 and February 2009.

The recovery period was intense, and it only managed to recover somewhat in March 2013. Currently, the losses experienced due to the Covid pandemic are similar to that experienced on the stock market at the beginning of the 2017 year.

How Much Does the Average Person Have Invested in Robinhood?

In November 2020, Businessofapps.com released a report on the users for Robinhood. The aim of founding fathers Vladimir Tenev and Baiju Bhatt wanted to introduce a product where there are no minimum investment amounts specified.

The reason for this was to give micro investors a chance to become active in the stock market and not lose out on opportunities because they could not afford the minimum capital required by other online traders.

Robinhood generates income through a process named payment for order flow. But in essence, they advertise the application as free to their users. Every time that a user trades on the application, the creators of the app then transmits data to larger entities. These entities then produce an array of orders instantly. This is how Robinhood then receives compensation.

This is an excellent initiative for earning funds for the creators since the platform currently boasts more than 13 million online traders, with the average person investing between $1000 to $5000.

The average age of the trader on the platform starts at 26 years. More than that, it is reported rated at 4th and 7th place respectively on the iOs and Android stores for the number of downloads from users. These users are affectionately known as Robinhoodies. These trades are getting much attention because they are very concentrated in a battered market.

Suppose that for purposes of this example, we say that the average person has $5000 invested in their Robinhood account. When this figure is multiplied by the 13 million users, it provides a $65 billion capital sum.

In a blog article posted by Robinhood recently, they announced that they had lowered their interest rates from 5% to 2.5%, which might see the number of younger Robinhoodies grow even more. In 2020 alone, Robinhood reported having 3 million new users onboard, despite widespread financial difficulties.

Now, this is a large sum of money for any individual, but in stock market terms, this is a mere drop in the bucket, so to speak. Compared to Netflix on the NASDAQ indices, they hold a capitalized market share of $196.57 billion. That is three times more than the figure for Robinhood.

The main focus for Robinhood is expelling any fears that their investors might have by providing the most up to date information on your portfolio and how this can be managed better for improved results.

They will also place great emphasis on their cash management products, which 1.5 million of their customers already make use of.

How to see Profits from Investments in Robinhood

Seeing what your profit margin is on the application is just as easy. Proceed to the website, and click on the Account tab. You will be presented with your stock portfolio, the amount you invested, and then your total returns.

You merely have to navigate to the data set and enter a range that is longer than what you have used Robinhood for. Alternatively, you can navigate to your homepage. Here you will have access to all your profits and losses accordingly. It will be recorded under your portfolio total. It will also give you an overall view of the health of your portfolio on the main page of the website.

The information provided to you is very granular and detailed. You are even able to see the profit or loss margin for each of your stocks individually.

Another method includes making use of the Robinhood Recap feature on the mobile app. It takes the user on their investment journey for the last year. Best of all is that the information you select is entirely customizable by the user. So you can filter only the information you want the most at that given point in time.

The only reported permutations to using the Robinhood Recap feature is that you had to have an active account and should have performed a few transactions by the 15th December 2020.

The cash management feature operates based on the premise that users can earn interest on all their uninvested capital, use their bank cards to make online purchases, trade, and even make EFTs via Robinhood.

One might ask why you should invest in the cash management feature. We can report that since the 16th March 2020, Robinhood has been offering a competitive APY of 0.30% on a trader’s uninvested capital via a program called the “Deposit Sweep program.” Traders earn compound interest each and every day.

In summary, every time a trader sells shares or deposits capital, they earn interest on the capital to supplement their finances at a later date. In 2020, the traders who participated in the program earned in excess of $2.5 million back in compound interest.