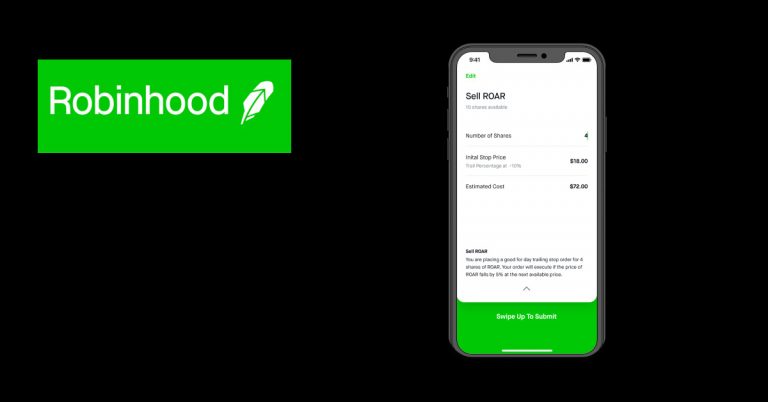

How Much of Your Money is Insured at Robinhood

Investing your funds in Robinhood is a smart move. However, the majority don’t know whether their assets are insured with this company. You are supposed to know if your hard-earned cash is insured and the method of insurance that Robinhood follows for the security of your assets. Also, how much of your money is insured at Robinhood.

The SIPC protects money up to $500,000 for securities and $250,000 for cash claims. The SIPC offers insurance to brokerage firms to protect the depositors. It protects the depositors from theft attacks or any illegal access to your account.

Keeping money protected is important. When your account is insured, you don’t take any risk when making a major investment. Therefore, to keep your assets protected, Robinhood accepted the SIPC insurance plan. Recently, it announced its new checking & savings account for its clients, which gives a 3% interest on the investment.

This article will help you to know more about how money is insured at Robinhood. We will further provide you with information on whether Robinhood accounts are insured by FDIC and how safe your assets are.

Is your money insured at Robinhood?

Brokerage clients who choose in Cash Management decide to take part in a deposit sweep plan (the IND (IntraFi Network Deposit) Sweep Service). Their money which is not invested will automatically be moved or swept, into the deposits through a system of program banks. By Cash Management, money transferred at these banks is usually entitled to FDIC insurance for a limit of $1.25 million, and up to $250,000 for each program bank.

This includes the deposits that you might by now hold at the bank in a similar tenure capacity. The banks will as well give interest on the swept money, and the present APY (annual percentage yield) that you will get is 0.30%. However, Robinhood is not accountable for monitoring the total amount of your deposits in either program bank. It does not matter if these deposits are done through the Cash Management deposit sweep program or else, to determine if the sum on deposit is beyond the maximum offered FDIC insurance.

As a result, you are in charge of monitoring the full amount of your money on deposit with every program bank (incorporating the amounts in your other accounts in the program bank held in a similar tenure capacity) so as to determine the amount of deposit insurance coverage accessible to you on these deposits.

Please keep in mind that until the money is swept to the program bank, it is covered by the SIPC protection. Cash is not covered by the SIPC protection when on deposit in a program bank. Robinhood is not a bank itself; instead, it provides the Cash Management aspect as a branch of a brokerage account and collaborates with program banks. Robinhood debit card is given by Sutton Bank.

Is Robinhood insured by FDIC?

The FDIC offers insurance policies to online platforms and banks that cover members’ savings and checking accounts on the slim probability that they may fail. However, The FDIC usually insures just deposits. It doesn’t ensure mutual funds, securities, or related kinds of investments that online platforms or banks provide.

The company covers personal cash reserve accounts of up to $1,000,000.00, as well as $2,000,000 for joint accounts. This means that if your account holds up to that amount and Robinhood collapses, the FDIC will cover you from all the losses that you suffered. The FDIC does not as well cover market losses that you suffer that might occur in your trading choices!

Remember, you are always accountable for monitoring all your assets in Robinhood to ensure that you have not exceeded the limits of FDIC insurance. It could mean that some of your money is not insured. Your stocks, as well as your ETF funds, are covered by SIPC insurance, and the money in your brokerage account for buying assets. If you make use of the online banking services provided by Robinhood, they are usually covered by FDIC insurance.

How much of your money is insured at Robinhood

Your money in Robinhood is insured for up to a maximum of $250,000 cash claims and a maximum of up to $500,000 for securities by the SIPC (Securities Investor Protection Corporation).

The SIPC protects money deposits in your Robinhood account in the improbable occurrence of Robinhood collapse or failure. According to Baiju Bhatt, the CEO and co-founder of Robinhood, The insurance sum is similar (to the FDIC), and it permits them to give this high rate. The Explanatory brochure is accessible on www.sipc.org or upon request.

Does Robinhood steal your money?

Cyber hacking has been on the rise, and it has become one of the leading threats to investors’ financial well-being. Sadly, many brokerage firms have not devoted money that is required to keep off cyber hacking on brokerage accounts taking place.

According to the Bloomberg News report, the experience of some clients on Robinhood Markets Inc.’s brokerage app says that their cash was stolen. The Robinhood said that the issue did not start from a breach of its systems. Yet, lacking an emergency number to call is what left so many clients stranded, leaving them with a little avenue to know if their money had been lost.

Experts on Cybersecurity states that the boom in online trading may have developed a parallel chance for hackers. This doesn’t exclude diligent investors because they are also falling into this trick. Hackers have been using sophisticated techniques that most people fail to notice early enough.

The best practice is to make promises so as to cover 100 % of all the losses incurred due to illegal activity in the brokerage account. The stumbling block is whether the business will rule out that the breach was certainly criminal or blame the investors.

If they do a thorough investigation and confirm the clients got losses because of illegal activity, Robinhood will compensate fully for all the clients who suffered these losses. The company is also working towards resolving these issues as soon as possible and also looking for a way to avert such losses in the future. This is being done by the Fraud Investigations Team hired by the company.

According to its website, Robinhood will cover all the losses that have been incurred from illegal activities from its brokerage firms. The company has hired 2500 staff in call centers and service teams and 1300 in other branches. They will help to resolve these issues.

Is Robinhood safe?

The well-liked mobile app has over 10 million users currently. Yet, a lot of people doubt if it has the right security measures put in place. Let’s learn more regarding Robinhood’s safety below;

Robinhood guarantees its users have protection all the time. Since it is a securities brokerage, it is governed by the SEC (the Securities and Exchange Commission). Even though the application might have outages at times, which is very common in mobile apps; your cash is very safe in the hand of Robinhood regardless of the current status of the app.

Actually, any cash that you transfer to Robinhood accounts is secured by the SIPC (Securities Investor Protection Corporation. The organization secures up to $500,000 in the form of securities and up to $250,000 for cash. However, cryptocurrency is not secured by the SIPC.

The security team in Robinhood’s has also put several measures in place in order to safeguard all your accounts. This is be done by adding verification codes when you are signing into your account, for instance, FaceID, pin code, two-factor verification, or TouchID.

Is it safe to sign up with Robinhood? Absolutely Yes! It is very safe. However, you will still have to present your Social Security Number to link your bank account. This is an essential step in setting up any brokerage account regardless of which company you choose to go with.

After Robinhood authenticates your bank credentials, it will by no means access them another time. Also, Your Social Security Number is protected. These are sensitive details; thus, they are encrypted before they are stored. Robinhood Security Team employs many advanced measures that help to protect its customer’s accounts. This guarantees a fair, safe, and secure experience with them.

Some of the security measures include:

- The password of your account is hashed by the use of the industry-standard BCrypt hash algorithm. The password is not stored in plaintext at all.

- Sensitive information, like your social security number, is usually encrypted before being stored.

- Robinhood’s web and mobile applications communicate securely with their servers through the Transport Layer Security (TLS) practice with current configurations and codes.

- Once they confirm your banking credentials, they will never again access them. They use trustworthy third-party incorporation to access any bank account information, like your account number and the available balance.

Robinhood’s security, along with the SIPC is available to lend a hand should you have other worries. You may set up gadget monitoring for additional protection and discover the best practices for generating strong passwords.